- RetireHub

- Posts

- Budgeting for Big Purchases in Retirement

Budgeting for Big Purchases in Retirement

Trivia: The novel Pride and Prejudice was written by which author?

Rise and shine, RetireHub community! ☀️ Your Monday newsletter is here!

Today we have an exciting announcement. RetireHub Premium officially has a new look and TONS of new features. A few of our favorites?

Daily games (like Solitaire, Snake, Tetris, and more!)

More trivia! (See how you stack up against other RH members)

Medicare Classes!

Personal Finance Classes!

More daily deals!

Daily free e-books!

A job board (with jobs tailored for 50+ year olds)

And we’re building more weekly! We’re really excited about this, and would love for you to test it out risk-free, so we’re giving everyone a free 7-day trial that signs up at the link below:

Top Deals From Around The Web

We find the best daily online deals so you don’t have to!

🥜 15% OFF – KIND Chocolate Cherry Cashew Bars (Antioxidant Blend)

Enjoy a sweet-and-tangy snack made with real chocolate, cherries, and crunchy cashews. These KIND bars are packed with wholesome ingredients and antioxidants, making them a satisfying choice for mid-day cravings or on-the-go fuel. Great for purses, desks, or travel days when you want something tasty but balanced.

🦷 33% OFF – COSLUS Professional Water Flosser

Upgrade your dental routine with this powerful water flosser designed to clean deep between teeth and along the gumline. With multiple pressure settings and a large water tank, it’s easy to customize for comfort while getting a thorough clean. A simple way to support healthier gums and fresher breath at home.

🍞 13% OFF – Elite Gourmet Cool Touch Toaster with 6 Settings

Make perfect toast every time with this versatile toaster featuring six temperature settings and extra-wide 1.25″ slots for bagels, waffles, specialty breads, and more. The cool-touch exterior and ETL certification make it a safe, dependable addition to any kitchen. Ideal for cozy breakfasts, afternoon snacks, or warming leftovers with ease.

Want even more deals? Signup for RetireHub Premium (risk-free for 30 days) and get the best deals from across the web.

What We’re Reading

Get these e-book deals before they’re gone.

By: Violet McBride I never expected my biggest enemy to have gentle hands—or a little girl begging for a puppy. Cyrus Whelan is a gruff widowed detective who keeps writing me citations… until forty rescue dogs need saving. Working side by side, I discover his grief, his daughter’s sweet hope, and a man terrified of loving again—just as I’m falling for him. |

Want the best free e-books delivered daily? Signup for RetireHub Premium (risk-free for 30 days) and get the best deals from across the web.

On this day in 1915, the first commercial telephone call across the United States was made, connecting New York City and San Francisco and proving that voices could travel coast to coast for the very first time.

Budgeting for Big Purchases in Retirement

Retirement is often described as a time to relax, enjoy freedom, and finally focus on the things that matter most. But even in this slower, more intentional stage of life, big purchases still come up—whether it’s a new car, home repairs, travel plans, medical equipment, or helping family. Smart budgeting makes these decisions feel empowering instead of stressful.

The first step is knowing your “true” monthly picture. Beyond regular bills, include seasonal costs like insurance premiums, property taxes, and maintenance. When you see what’s left after necessities, you can decide how much can safely go toward long-term goals without dipping into emergency funds or essential savings.

Next, separate “want” from “need,” without guilt. A new roof or medical device is a need; a dream cruise or luxury recliner is a want—but both deserve planning. For each big purchase, write down why it matters to you. Emotional value counts, especially in retirement when quality of life matters just as much as numbers on a page.

Create a dedicated savings bucket for each goal. Instead of one big “savings” pot, try labeling funds: “Travel,” “Car Replacement,” “Home Updates,” or “Health.” This makes progress visible and prevents accidentally spending money meant for something important. Even small monthly amounts add up faster than you expect.

Timing matters more than price alone. Ask yourself: Can this wait? Sometimes delaying six months or a year makes a purchase much easier, especially if it allows you to save more or avoid using credit. If it’s urgent, look at payment options carefully and avoid high-interest plans that quietly inflate the true cost.

Always protect your safety net. Your emergency fund should stay untouched except for true emergencies—unexpected repairs, medical issues, or urgent travel. Big purchases should never leave you without a cushion. If a purchase would drain your backup money, it’s a sign to rethink timing or scale.

It also helps to talk it through. Discuss plans with a partner, trusted family member, or financial advisor. A second set of eyes can spot risks you might miss and help you feel confident instead of anxious about large decisions.

Finally, remember that money in retirement isn’t just about preserving—it’s about living. Thoughtful budgeting lets you say yes to what truly matters while still feeling secure. Whether it’s a family trip, a safer home, or a long-wanted upgrade, planning ahead turns big purchases into joyful milestones instead of financial worries.

With a clear picture, honest priorities, and steady saving, you can make big retirement purchases wisely—and enjoy them fully.

What Big Purchase Are You Most Likely Planning in Retirement? |

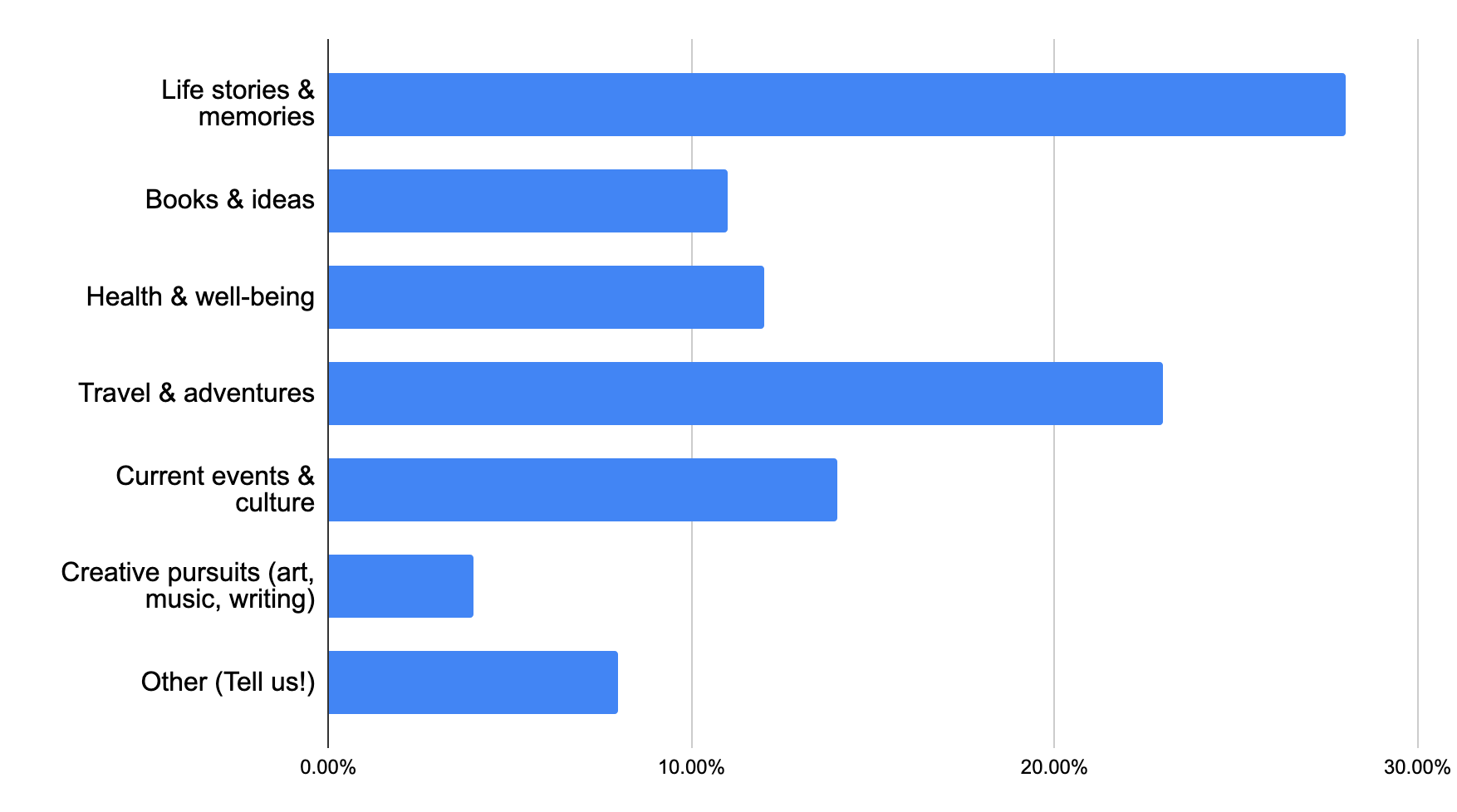

Yesterday’s Poll Results: What Would You Most Enjoy Talking About in a Senior Circle?

Life stories and memories came out on top, showing that what people really want most is the chance to share where they’ve been and what they’ve lived through. Travel and adventures were a strong second, proving that curiosity and wanderlust don’t fade with age. Overall, the results show a beautiful mix of reflection and forward-looking interest—people want to honor their past, stay engaged with the world, and keep learning and growing together.

TOP COMMENTS

“Finding life’s purpose after professional career.”

“A bit of all of them, but life stories and memories would be at the top. I wish I had talked to my parents about a lot of things that I'm very curious about now.”

“A combination or little bit of everything.”

“We meet up once a month, at restaurants around yown. Our friendship grew from us meeting on bicycle rides. The stories we share make us laugh and bring great memories. Most of us still ride, for ones that do not, they enjoy our stories.”

“All of the choices would make it interesting and interactive!”

“I equally love travel and adventures!”

“We have a senior circle! We talk about all of these and more! We travel together, meet for coffee, share books and even volunteer!”

Why Decluttering Alone (or With a Resistant Partner) Feels So Hard — and What Actually Helps

Clearing out clutter can feel impossible when you’re doing it alone or dealing with a partner who doesn’t share your goals — and it’s not because you lack willpower but because real-life constraints like low energy, emotional fatigue, and resistance make the task heavy and draining. Much of the typical advice assumes uninterrupted time, shared commitment, and high motivation — conditions most people don’t have — so instead of helping, it often leads to burnout and self-doubt. The article highlights practical ways to make progress that respect your limits, like short sessions, claiming personal decision-making space, and trusting yourself rather than pushing through exhaustion.

Follow us on Social Media!

Join an online community thriving in retirement! Find us on:

Every day we post retirement tips, highlights from our newsletter so you can comment and discuss in the community, and some fun retirement-themed motivation!

Slang Phrase of the Day

Phrase: Hip parade

Meaning: A playful phrase meaning something trendy, exciting, or full of energy — often used to describe an event, idea, or moment that feels lively and modern.

In a sentence: “Seeing my grandkids dance to their favorite songs felt like a real hip parade — lively, joyful, and full of fun.”

Good News of the Day

Woman Wins £4.5 Million Mansion After Ignoring Husband’s Advice Not to Enter Contests

A woman from England defied her husband’s suggestion to stop entering prize draws and kept participating in charity sweepstakes, which paid off in a huge way when she won a £4.5 million mansion complete with cash and luxurious features — a life-changing prize that came mortgage-free and fully furnished. She celebrated the win as proof that perseverance and a little optimism can yield big rewards, and the victory also helped raise funds for a charitable cause tied to the prize draw. The unexpected win has given her and her family newfound financial flexibility and security, marking an extraordinary twist of luck after years of entering competitions.

Other Publications We Like

Check out these other email newsletters we think you’ll enjoy!

RetireHub Trivia

Want even more trivia? Signup for RetireHub Premium (risk-free for 30 days) and get the best deals from across the web.

Want more trivia? Play our “Nostalgia Trivia Game” on our site! We add fresh questions daily, so there’s always something new to test your knowledge.

Not into trivia? No worries! We’ve got plenty of other fun games to enjoy, like:

Which planet has the shortest day, completing a rotation in about 10 hours? |

The novel Pride and Prejudice was written by which author? |

Which U.S. city is known as “Motor City” for its historic automobile industry? |

Want even more trivia? Signup for RetireHub Premium (risk-free for 30 days) and get the best deals from across the web.

A QUICK ASK: First off, thank you for reading RetireHub every day. It fills our cup that so many thousands of people get joy from our little publication.

As you know, good content costs money. In order to continue supporting ourselves and to continue delivering the content you enjoy every day, we need to pay our writers. If you can, we ask you to subscribe to our paid account (for $5/month - less than a cup of coffee!) below.

If you choose to purchase a paid subscription, please know you’re supporting not only our publication, but tens of thousands of other 50+ year old Americans that get joy, entertainment, financial tips, and more from RetireHub every single day.

If you don’t join the paid plan (or can’t), no worries at all. We know times are tough. Thank you for being a part of our tiny, joyful part of the Internet.

- Jay

**RetireHub may receive affiliate compensation for links clicked within this newsletter.

***RetireHub may share poll results with advertisers.