- RetireHub

- Posts

- How to Set Up Automatic Bill Pay Without the Stress

How to Set Up Automatic Bill Pay Without the Stress

Trivia: What is the tiny dot over the letters “i” and “j” called?

Rise and shine, RetireHub community! ☀️ Your Monday newsletter is here!

Today we have an exciting announcement. RetireHub Premium officially has a new look and TONS of new features. A few of our favorites?

Daily games (like Solitaire, Snake, Tetris, and more!)

More trivia! (See how you stack up against other RH members)

Medicare Classes!

Personal Finance Classes!

More daily deals!

Daily free e-books!

A job board (with jobs tailored for 50+ year olds)

And we’re building more weekly! We’re really excited about this, and would love for you to test it out risk-free, so we’re giving everyone a free 7-day trial that signs up at the link below:

Top Deals From Around The Web

We find the best daily online deals so you don’t have to!

🧲 33% OFF – Gripper Non-Slip Rug Grippers for Hardwood Floors

Keep your rugs safely in place with these reusable, low-profile rug grippers designed to prevent slipping, curling, and bunching on hard floors. Easy to apply and remove without sticky residue, they help reduce tripping hazards while keeping rugs looking neat. A simple, practical safety upgrade for living rooms, hallways, or entryways.

👟 41% OFF – SpaceAid 7-Tier Rotating Shoe Rack Tower (360° Lazy Susan)

Maximize closet space with this sleek, vertical rotating shoe rack designed to keep footwear visible, organized, and easy to access. The 360-degree spinning design and seven roomy tiers make it simple to store shoes, handbags, or accessories without clutter. Ideal for closets, bedrooms, or entryways when you want smart storage with a small footprint.

📖 20% OFF – Amazon Kindle Paperwhite Signature Edition (Like New)

Enjoy a premium reading experience with this refurbished Kindle Paperwhite Signature Edition, featuring a crisp glare-free display, adjustable warm light, and wireless charging. It’s lightweight, easy on the eyes, and holds thousands of books—perfect for travel, bedtime reading, or daily use. A smart way to upgrade your reading without the full new-device price.

Want even more deals? Signup for RetireHub Premium (risk-free for 30 days) and get the best deals from across the web.

What We’re Reading

Get these e-book deals before they’re gone.

By: Charlotte McGregor Colleen Murray leaves Boston for the Scottish village of Kirkby to explore her late father's heritage. She finds herself captivated by Alex Fraser, owner of the local B&B. Their shared love of horses sparks a connection. But as love blooms, Alex's past emerges to threaten their future. Will Colleen find her forever love or be heartbroken? |

Want the best free e-books delivered daily? Signup for RetireHub Premium (risk-free for 30 days) and get the best deals from across the web.

On this day in 1927, the first feature-length motion picture with synchronized sound, The Jazz Singer, premiered in New York City. Its success marked the beginning of the end for silent films and forever changed the movie industry by ushering in the era of “talkies.”

How to Set Up Automatic Bill Pay Without the Stress

Automatic bill pay can feel intimidating at first—but when set up thoughtfully, it’s one of the simplest ways to reduce monthly stress and stay organized. Instead of juggling due dates, envelopes, and reminders, automatic payments quietly handle the essentials in the background, freeing up your time and mental energy.

Start by deciding which bills are best suited for automation. Fixed monthly expenses—such as utilities, internet, phone service, insurance premiums, streaming subscriptions, and credit cards—are ideal candidates. Variable bills, like credit cards or utilities, can still be automated by paying either the minimum due or the full balance, depending on your comfort level and cash flow.

Next, choose a single, reliable payment source. Most people use a checking account for automatic bill pay, while some prefer a credit card (especially if they earn rewards). Whichever you choose, make sure it consistently has enough funds to avoid overdraft fees or declined payments. Keeping a small buffer in your account can provide extra peace of mind.

When setting up automatic payments, pay close attention to timing. Select payment dates a few days after your income typically arrives, such as after a pension, Social Security, or paycheck is deposited. This ensures funds are available and reduces anxiety about account balances. Many companies allow you to choose your own payment date—use that flexibility to your advantage.

To stay in control, keep a simple list of all automated bills. Write down the company name, amount (or range), payment date, and funding source. This can live on paper, in a spreadsheet, or in a notes app—whatever feels easiest to review monthly. Knowing exactly what’s happening helps automatic bill pay feel empowering rather than mysterious.

It’s also wise to set up alerts and confirmations. Most banks and service providers offer email or text notifications when a payment is scheduled or processed. These gentle check-ins provide reassurance without requiring action from you.

Finally, remember that automatic doesn’t mean permanent. You can pause, change, or cancel payments at any time. Review your setup once or twice a year to ensure it still fits your needs, especially after changes in income, expenses, or lifestyle.

With a thoughtful setup, automatic bill pay becomes less about giving up control—and more about gaining calm, consistency, and confidence in your financial routine.

How do you currently handle your regular bills? |

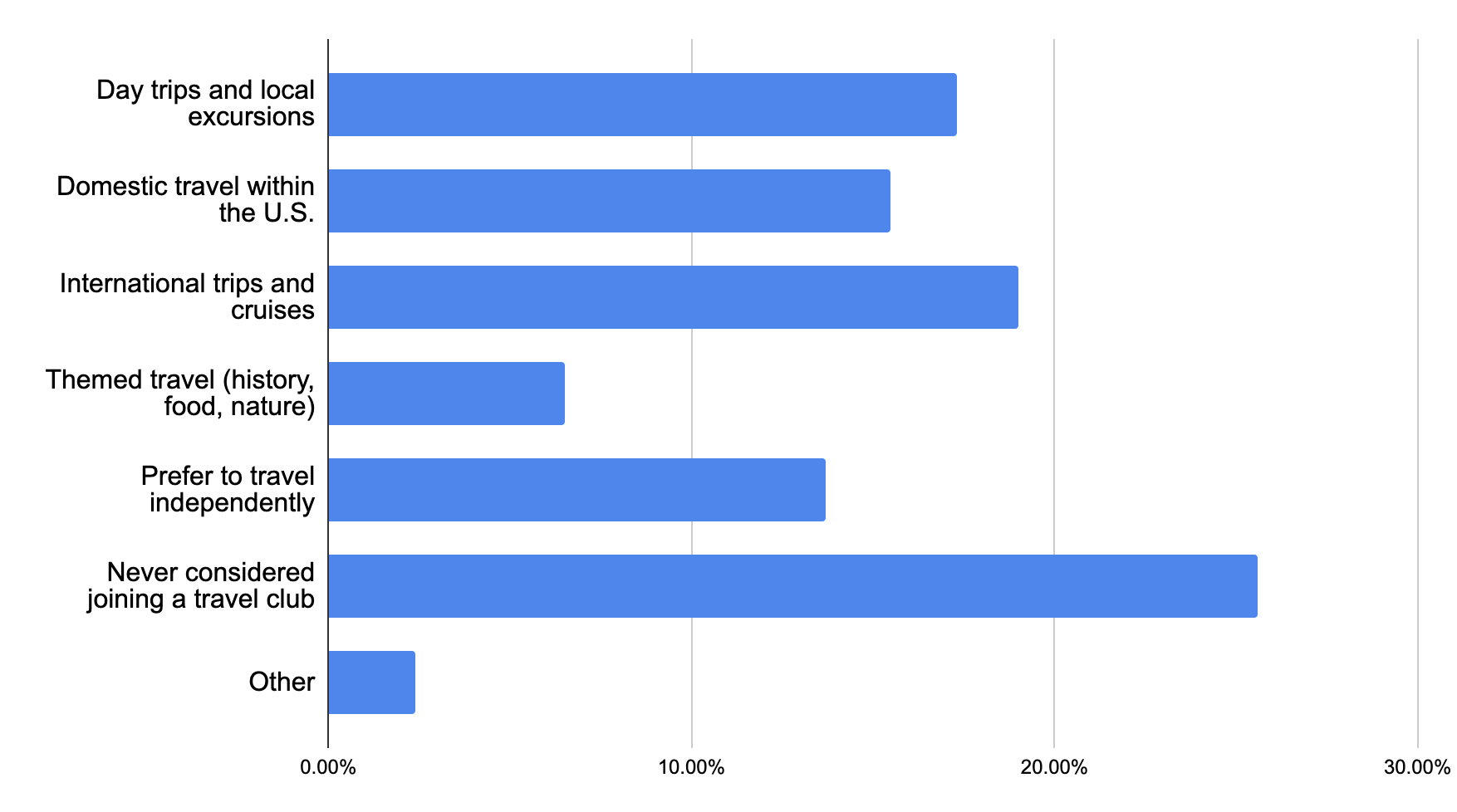

Yesterday’s Poll Results: Which travel club experience sounds most appealing to you?

These results suggest that while curiosity about travel clubs is growing, many people are still in the early “considering it” stage. The largest group—over a quarter of respondents—said they’ve never thought about joining a travel club at all, pointing to a big opportunity for awareness and education. Among those who are interested, international trips and cruises lead the way, followed closely by day trips and domestic travel, showing a healthy mix of wanderlust and practicality. Notably, a meaningful number of respondents prefer to travel independently, highlighting that flexibility remains important. Overall, the poll reflects a community that values travel—but wants clear benefits, comfort, and choice before committing to a group experience.

TOP COMMENTS

“I have heard of friends that traveled with groups they already belonged to. Church tours to Europe. All successful. But joining strangers might scare me off.”

“Also interested in international trips”

“I would enjoy any of these, if we could afford them.”

9 Creative Groups That Make It Easier to Build Friendships After 60

Finding meaningful connections after age 60 can feel harder than it once did, especially once roles like parenting and work no longer provide built-in social circles — but there are vibrant groups out there ready to help you meet like-minded people. From established networks like Women’s Connection and The Red Hat Society to online platforms such as Stitch and the Virtual Senior Center, these communities offer ways to connect through shared interests, support, activities, and events. Other options include Meetup groups you create or join locally, Daybreaker movement meetups, global travel communities like Journeywoman, and service-oriented clubs such as Rotary International. Whether you prefer something local, virtual, social, or service-based, these creative communities provide welcoming spaces to build friendships, stay engaged, and share life’s adventures with others who understand the joys and challenges of this stage of life.

Follow us on Social Media!

Join an online community thriving in retirement! Find us on:

Every day we post retirement tips, highlights from our newsletter so you can comment and discuss in the community, and some fun retirement-themed motivation!

Slang Phrase of the Day

Phrase: Fresh pick

Meaning: A fresh pick is something newly chosen or selected because it stands out as especially good, useful, or timely—often referring to a recommendation, favorite item, or top choice.

In a sentence: “This book club novel is my fresh pick for the month—it’s engaging, easy to follow, and perfect for cozy winter reading.”

Good News of the Day

Join the World in Counting Birds: Great Backyard Bird Count Returns to Help Feathered Friends

The Great Backyard Bird Count (GBBC) is a fun, worldwide citizen‑science event running February 13–16, 2026, that invites people of all ages and experience levels to spend at least 15 minutes observing and tallying the birds in their yards, parks, balconies, or favorite outdoor spots. Participants submit their sightings through apps like Merlin Bird ID or eBird, and those checklists help researchers at the Cornell Lab of Ornithology, National Audubon Society, and Birds Canada understand how bird populations are faring around the globe—a vital tool for conservation and habitat protection. Last year, more than 800,000 people and over 8,000 bird species were counted, showing how ordinary birdwatchers can make an extraordinary contribution to science simply by watching and reporting what they see.

Other Publications We Like

Check out these other email newsletters we think you’ll enjoy!

RetireHub Trivia

Want even more trivia? Signup for RetireHub Premium (risk-free for 30 days) and get the best deals from across the web.

Want more trivia? Play our “Nostalgia Trivia Game” on our site! We add fresh questions daily, so there’s always something new to test your knowledge.

Not into trivia? No worries! We’ve got plenty of other fun games to enjoy, like:

Which insects are known to “farm” aphids for sweet liquid? |

Which modern kitchen appliance was discovered by accident when a candy bar melted? |

What is the tiny dot over the letters “i” and “j” called? |

Want even more trivia? Signup for RetireHub Premium (risk-free for 30 days) and get the best deals from across the web.

A QUICK ASK: First off, thank you for reading RetireHub every day. It fills our cup that so many thousands of people get joy from our little publication.

As you know, good content costs money. In order to continue supporting ourselves and to continue delivering the content you enjoy every day, we need to pay our writers. If you can, we ask you to subscribe to our paid account (for $5/month - less than a cup of coffee!) below.

If you choose to purchase a paid subscription, please know you’re supporting not only our publication, but tens of thousands of other 50+ year old Americans that get joy, entertainment, financial tips, and more from RetireHub every single day.

If you don’t join the paid plan (or can’t), no worries at all. We know times are tough. Thank you for being a part of our tiny, joyful part of the Internet.

- Jay

**RetireHub may receive affiliate compensation for links clicked within this newsletter.

***RetireHub may share poll results with advertisers.