- RetireHub

- Posts

- Updating Beneficiary Designations: A Crucial Step

Updating Beneficiary Designations: A Crucial Step

Trivia: The medical discovery of insulin as a treatment for diabetes occurred in which decade?

Rise and shine, RetireHub community! ☀️ Your Monday newsletter is here!

Today we’re sharing smart tips on updating beneficiary designations: a crucial step, along with the best deals, fun trivia, and more!

Top Deals From Around The Web

We find the best daily online deals so you don’t have to!

🪑 15% OFF – Belord Outdoor Swivel Rocking Patio Chairs (Set of 2)

Upgrade your porch or patio with these elegant swivel rocking chairs designed for both comfort and durability. Featuring weather-resistant wicker, soft cushions, and a smooth 360° swivel, they’re perfect for relaxing mornings, sunny afternoons, or evening chats under the stars.

🐦 35% OFF – Clear Window Bird Feeder with Removable Tray

Bring the joy of birdwatching right to your window with this crystal-clear feeder that offers up-close views of your feathered visitors. Easy to install with strong suction cups and a removable tray for quick cleaning, it’s a delightful way to connect with nature from the comfort of home.

👒 29% OFF – Breathable Bucket Sun Hat with Neck Flap

Stay shaded and cool during outdoor activities with this lightweight, quick-drying sun hat featuring UPF 50+ protection and a wide brim. Great for gardening, fishing, walks, or travel—it offers coverage for your face, neck, and ears while keeping you stylishly sun-safe.

What We’re Reading

Get these e-book deals before they’re gone.

By: Hart & Varengo In a Paris gripped by nuclear threat, disgraced spy Perry Hall is forced back into action, joined by his loyal dog and a bold young agent. As a cunning assassin unleashes chaos, Perry races against time to prevent a catastrophic explosion on the Seine. Gritty, suspenseful, and laced with humor, this fast-paced thriller blends espionage, vengeance, and heart-stopping action. |

On this day in 1916, President Woodrow Wilson signed the National Park Service Organic Act, officially creating the National Park Service under the U.S. Department of the Interior. The act established a mission to preserve the country’s natural and historic treasures “unimpaired for the enjoyment of future generations.”

It was a landmark move that helped shape America’s approach to conservation, ensuring that the beauty of places like Yellowstone, the Grand Canyon, and countless other national parks would be protected—and cherished—long after today.

Don’t Forget to Update Your Beneficiaries: A Simple Step That Can Make All the Difference

When it comes to estate planning, many people think having a will or trust is enough. But there’s another critical piece that’s often overlooked—beneficiary designations on financial accounts, insurance policies, and retirement plans. Keeping these up to date is just as important as writing a will, and yet it’s one of the most commonly neglected tasks.

Why Beneficiary Designations Matter

Beneficiary designations override your will. That means no matter what your will says, the person listed as the beneficiary on your life insurance, IRA, 401(k), or annuity will receive the funds directly. These designations are legally binding and take precedence over estate documents.

This can lead to unintended consequences. For example, if your ex-spouse is still listed as the beneficiary on your life insurance, they may receive the payout—even if you’ve remarried or stated otherwise in your will.

When Should You Update Them?

A good rule of thumb is to review your beneficiary designations any time there’s a major life event, such as:

Marriage or divorce

The birth or adoption of a child or grandchild

Death of a previously named beneficiary

Changes in your financial goals or family dynamics

Even if no major changes have occurred, it's smart to do an annual check-in to confirm everything is current and accurate.

Where to Look

Beneficiary designations are typically required on:

Retirement accounts (401(k), IRA, etc.)

Life insurance policies

Pensions

Annuities

Transfer-on-death (TOD) investment accounts

Payable-on-death (POD) bank accounts

Each institution has its own process for updating beneficiaries, so you’ll need to contact them individually or log into your account to make changes.

Tips for Smooth Updates

Use full legal names, not nicknames.

Be specific about percentages if naming multiple beneficiaries.

Add contingent (backup) beneficiaries in case the primary passes away.

Store copies of your updated designations with your estate plan.

Final Thoughts

Updating your beneficiary designations doesn’t take long, but it can prevent confusion, delays, and unintended heartbreak later on. It’s one of the simplest yet most powerful ways to ensure your assets go exactly where you want them to—and to the people you care about most.

📋 When Was the Last Time You Updated Your Beneficiary Information? |

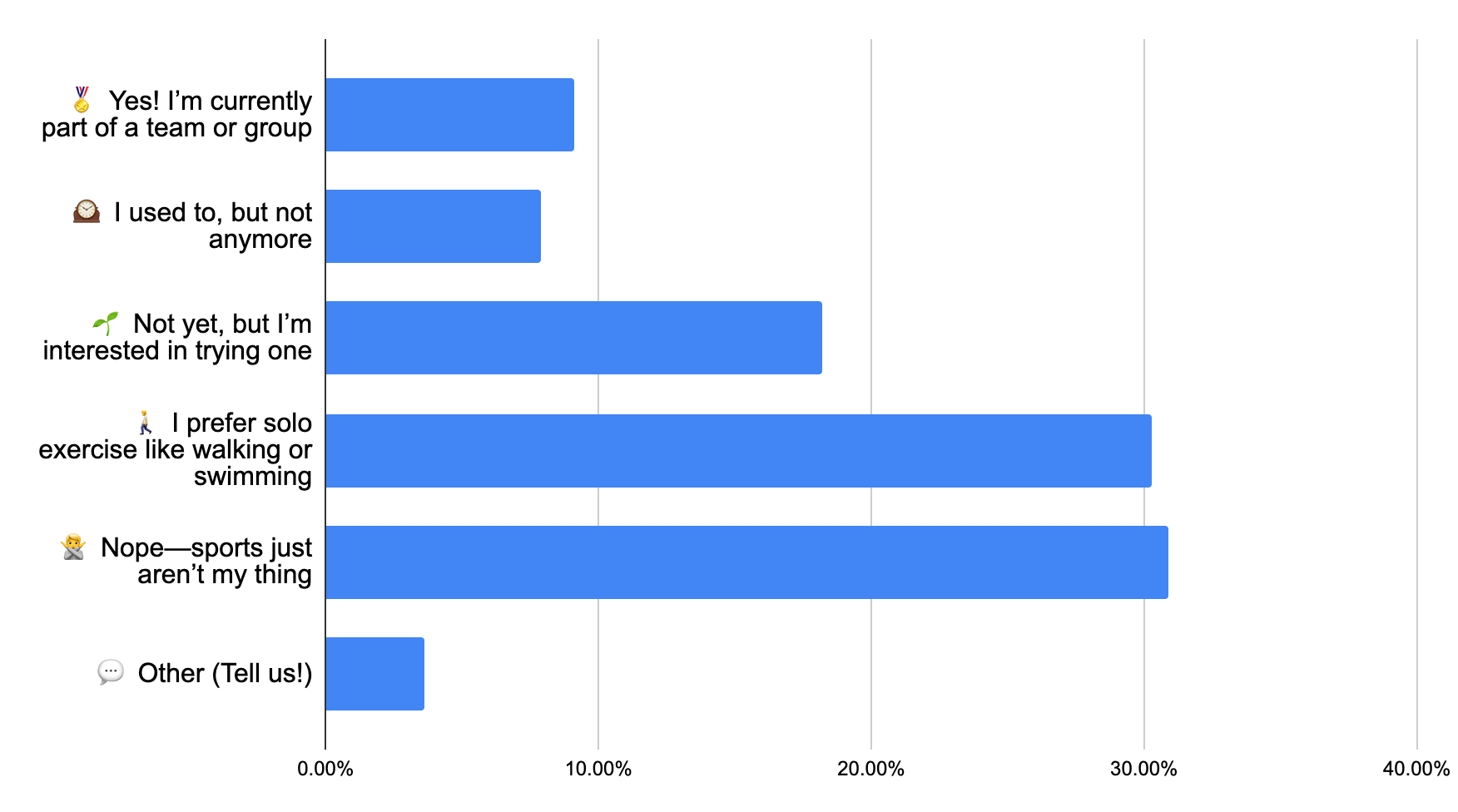

Yesterday’s Poll Results: Have You Ever Joined a 50+ Sports or Activity League?

It turns out that while competitive spirit is still alive, many in the 50+ crowd prefer to keep things solo. With 31% saying sports aren’t their thing and another 30% choosing solo movement like walking or swimming, it’s clear that gentle independence is the favored fitness path. That said, nearly 1 in 5 respondents are curious about trying a league or group activity, showing there’s still appetite for teamwork, camaraderie, and maybe a little friendly rivalry!

Ready to dust off your sneakers or join a group? It’s never too late to start.

TOP COMMENTS

“I injured my hip in my first softball game. Tried to play in 2 more games but couldn’t run the bases.”

“My husband and I play pickleball at our YMCA. We don't have a league. We just play recreationally.”

“Have been part of a 55+ golf group for the last 15 years, great way to make new friends and enjoy the social interaction.”

Housework for Mind and Mood: Why Chores Can Be Your New Best Habit

Tackling everyday household tasks—like sorting mail, scrubbing surfaces, or vacuuming—does more than keep your home tidy. Studies have found that regularly doing chores may lower the risk of dementia by around 21 percent over time. To stay motivated, try simple tricks like timing yourself or “task hopping” during TV commercials; even short bursts of activity can build momentum and make chores feel less daunting.

Want to make these daily routines even more meaningful? Consider treating your chore list like a tailored brain-boosting workout—tick off one small task at a time, and feel the joy of accomplishment (and clarity) grow.

Follow us on Social Media!

Join an online community thriving in retirement! Find us on:

Every day we post retirement tips, highlights from our newsletter so you can comment and discuss in the community, and some fun retirement-themed motivation!

Slang Phrase of the Day

Phrase: Kindcore

Meaning: A lifestyle aesthetic and cultural vibe that centers around being unapologetically kind, gentle, compassionate, and empathetic—especially in a world that often feels too fast, competitive, or harsh. Think cozy clothes, handwritten notes, helping neighbors, or simply choosing to be soft and warmhearted, even when it’s not trendy.

In a sentence: “Margaret’s weekly tea gatherings, her habit of sending birthday cards by mail, and the way she always compliments the checkout clerk—that’s Kindcore at its finest.”

Good News of the Day

Tenacious Tens: Two 10‑Year‑Old Girls Defeat Chess Grandmasters on Different Continents—Just Hours Apart

Two extraordinary 10‑year‑old girls made their mark in chess history on the same day—hours apart and oceans away. In Liverpool, Bodhana Sivanandan became the youngest girl ever to beat a grandmaster at just 10 years, 5 months, and 3 days old—shattering previous age records and earning the prestigious Woman International Master title. Meanwhile in Akron, Ohio, Keya Jha claimed her own milestone by defeating American grandmaster Bryan Smith, becoming the youngest U.S. girl to do so. These two young champions remind us that talent and determination have no age limit—and that sometimes, brilliance shines brightest in unexpected moments.

Other Publications We Like

Check out these other email newsletters we think you’ll enjoy!

RetireHub Trivia

Want more trivia? Play our “Nostalgia Trivia Game” on our site! We add fresh questions daily, so there’s always something new to test your knowledge.

Not into trivia? No worries! We’ve got plenty of other fun games to enjoy, like:

The medical discovery of insulin as a treatment for diabetes occurred in which decade? |

What is the largest species of penguin? |

What was the name of the Supreme Court case that legalized interracial marriage across the United States in 1967? |

A QUICK ASK: First off, thank you for reading RetireHub every day. It fills our cup that so many thousands of people get joy from our little publication.

As you know, good content costs money. In order to continue supporting ourselves and to continue delivering the content you enjoy every day, we need to pay our writers. If you can, we ask you to subscribe to our paid account (for $5/month - less than a cup of coffee!) below.

If you choose to purchase a paid subscription, please know you’re supporting not only our publication, but tens of thousands of other 50+ year old Americans that get joy, entertainment, financial tips, and more from RetireHub every single day.

If you don’t join the paid plan (or can’t), no worries at all. We know times are tough. Thank you for being a part of our tiny, joyful part of the Internet.

- Jay

**RetireHub may receive affiliate compensation for links clicked within this newsletter.

***RetireHub may share poll results with advertisers.